19.06.2024

Hydrogen Price Calculation – Crunching the essential numbers to find out the cost of Hydrogen.

In the relentless pursuit of sustainable practices and the mitigation of carbon footprints, hydrogen appears as an important choice in shaping the future of industries. For executives entrusted with steering corporate strategies towards environmental responsibility, understanding the intricacies of hydrogen price becomes a pre-requirement. In this article, we discuss the complexities of hydrogen pricing, its calculation, influencing factors, beneficiary sectors, and avenues for price optimization.

Understanding Hydrogen Price Dynamics

At the center of comprehending hydrogen price lies a complex interplay of diverse parameters. Unlike conventional fuels, the price of hydrogen is not solely dictated by market demand and supply dynamics. Instead, it is linked to the cost of electricity, the cost of green hydrogen production, distribution infrastructure, and technological advancements in electrolysis. As manufacturers of electrolysers, we recognize the importance of a full understanding of how hydrogen price is calculated.

On the Clean Hydrogen partnership website you have an overview of the cost and sales price of Hydrogen Valleys in EUR/kg of hydrogen.

Calculation Methodology of Levelised Cost of Hydrogen (LCOH)

Hydrogen price calculation needs a clear assessment of electricity prices, production, storage, transportation, and dispensing costs. At the production stage, factors such as electrolyser efficiency, and capital expenditure for equipment installation contribute significantly. Additionally, the cost of compressing or liquefying hydrogen, alongside storage infrastructure expenses, must be factored in. But the main driver of the high Hydrogen price is the cost of electricity, and in the case of Green Hydrogen, renewable electricity.

As hydrogen price calculation comprises several aspects, the industry stipulated a standard way of referring to hydrogen production cost, known as the Levelised Cost of Hydrogen (LCOH). It serves as a crucial metric, encapsulating the total cost of producing hydrogen over its entire lifecycle, making it a fundamental tool for decision-making and investment strategies.

Understanding the LCOH is imperative for companies across various industries aiming to integrate green hydrogen into their operations. This metric accounts for the entire cost spectrum involved in hydrogen production, encompassing capital costs, operational expenses, maintenance, and the cost of the energy source used for hydrogen generation.

Calculating LCOH involves equipment depreciation, energy input, efficiency losses, and operational lifespan. It offers a comprehensive overview, aiding companies in assessing the viability and competitiveness of green hydrogen against traditional energy sources such as grey or black Hydrogen.

By evaluating the LCOH and fully understanding the Hydrogen price, companies can make informed decisions, strategize investments, and determine the feasibility of incorporating green hydrogen technology within their infrastructure. Here is a simple formula you can use to calculate LCOH:

LCOH = (Investment + Maintenance + Operational - Revenue) / Hydrogen output

Understanding the cost implications of Stack and BoP (Base of Plant) integration is key. We'll provide insights into the economic factors affecting these systems, including initial investment costs, and operational expenses, for long-term viability. The first step towards building a Hydrogen production system is defining the following points:

- 1st - Define your utilization scenario.

- 2nd - Determine the annual, monthly, and daily operational hours under full load for the system.

- 3rd - Specify the optimization criteria for the system.

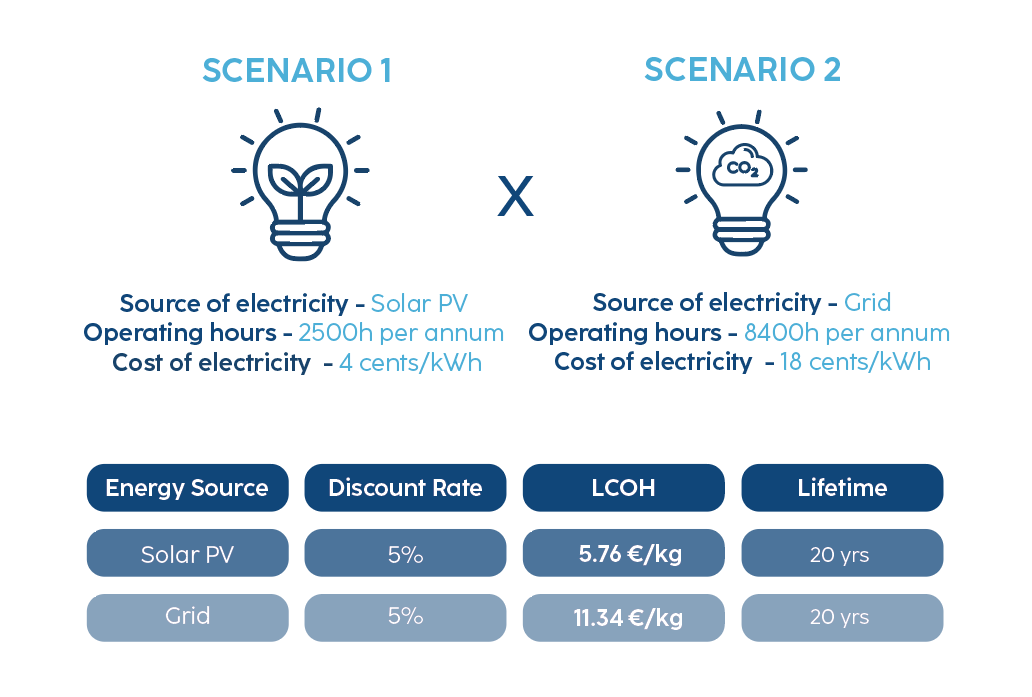

When optimizing for high efficiency, consider the significant impact of operational costs as exemplified in Scenario 1. If prioritizing low capital expenditure (capex), ensure maximum system operation hours are achieved, as exemplified in Scenario 2. It is crucial to consider the specific optimization goals for the system, as each scenario requires a tailored approach to maximize return on investment (ROI)

In the image above, the bottom two rows correspond to scenario 1 and scenario 2 respectively.

Cheap green electricity is essential. The cost of electricity is directly related to the LCOH, therefore as the cost of renewable energy goes down, so does green hydrogen’s price. The reduction of the cost of green electricity is a trend we can see in Northern Europe, where due to the early adoption of renewable energy sources, the current price of energy can be as low as 2.9 ct/kWh in some regions.

Download our Stack integration guide to learn more about the Hydrogen price:

If you want more information on hydrogen pricing or representing an engineering company looking to become a Hydrogen Stack integrator our latest guide will be a high-value asset. Download the guide here and ensure you will make informed decisions to achieve optimal efficiency.

Key Factors in Hydrogen Price Calculation

To calculate the price of hydrogen, it is crucial to break down the cost components and understand how they interplay. Let's delve into the major factors involved in the hydrogen price calculation process:

Electricity Cost

Electricity is a fundamental component of alkaline electrolysis and represents a substantial portion of the hydrogen production cost. Electricity prices vary widely depending on location, source, and regulatory factors, for companies aiming to produce hydrogen cost-effectively, securing a stable, low-cost electricity supply is essential. Renewable energy sources such as wind or solar can significantly reduce electricity costs, ensuring a greener and more sustainable hydrogen production process.

Electrolyser Efficiency

The efficiency of the electrolyser stack is a pivotal factor in the hydrogen price calculation. It is typically measured by the Lower Heating Value (LHV) of hydrogen produced per unit of electricity consumed. Modern alkaline electrolyser systems can achieve efficiencies of around 70-80%, with ongoing research and development efforts aiming to improve this figure. A more efficient electrolyser stack translates to lower electricity consumption and, subsequently, reduced production costs.

Capital Investment

Investing in the equipment necessary for alkaline electrolysis is a significant upfront cost. This includes purchasing the electrolyser stack, power supply system, and other associated infrastructure. The capital investment can vary depending on the scale of hydrogen production, and companies must assess their production needs and financial capabilities before embarking on hydrogen production projects.

Operational and Maintenance Costs

Operating and maintaining the electrolyser system requires ongoing expenses. This encompasses routine maintenance, replacement of components, and labour costs. Companies must budget for these operational expenses, and proactive maintenance practices can extend the lifespan of the equipment, reducing long-term costs.

Capacity Utilization

The capacity utilization of the electrolyser system is another critical factor in the hydrogen price calculation. A higher capacity utilization rate, achieved through continuous operation or efficient load management, can spread the capital and operational costs over a larger quantity of hydrogen produced, resulting in lower production costs per unit.

Hydrogen Purity and Quality

The desired purity and quality of the hydrogen product can impact the cost of production. In some cases, additional purification steps may be necessary to meet specific purity requirements, which can add to the overall cost.

Maintenance and Decommissioning

A comprehensive hydrogen price calculation should also account for the eventual maintenance and decommissioning of the electrolyser system at the end of its operational life. Planning for the retirement of equipment is essential to avoid unexpected costs.

Step-by-Step Hydrogen Price Calculation

Now that we've outlined the major factors influencing hydrogen pricing let's take a step-by-step approach to calculate the price of hydrogen using the alkaline electrolysis method:

- Step 1: Determine Electricity Costs

- Step 2: Account for Capital Investment

- Step 3: Include Operational and Maintenance Costs

- Step 4: Factor in Capacity Utilization

- Step 5: Electrolyser degradation

- Step 6: Water feedstock cost

- Step 7: Consider Hydrogen Purity and Quality

- Step 8: Sum It Up

- Step 9: Final Calculation

It's important to note that the final price of hydrogen is contingent on various external factors, such as market conditions, competition, and government incentives or subsidies, which can influence the economic viability of hydrogen production projects.

Fictional and Simplified Case Study: Hydrogen Price Calculation

Let's put this theoretical approach into context with a simplified case study where we will only consider some of the factors that influence the price calculation, therefore the final price in this study is for illustration purposes only. Suppose a company is considering investing in a 1 MW (megawatt) alkaline electrolyser system for hydrogen production. We'll calculate the price of hydrogen under specific assumptions:

- Electricity cost: €0.10 per kWh

- Electrolyser efficiency: 75%

- Capital investment: 1.2€ million

- Stack replacement cost after 10 years: 0.4€ million

- Equipment operational life: 20 years

- Annual operational and maintenance cost: 3% of CAPEX

- Capacity utilization rate: 90%

Step 1: Electricity Costs

- The electricity cost per kWh is €0.10, and the electrolyser efficiency is 75%.

- Electricity consumption = 1 / (Efficiency) = 1 / 0.75 = 1.33 kWh of electricity per cubic meter of hydrogen.

- Electricity cost per unit of hydrogen = €0.10 per kWh * 1.33 kWh = €0.133 per cubic meter of hydrogen.

Step 2: Capital Investment

- The total capital investment is €1.2 million + €0.4 million for Stack replacement, and the equipment's operational life is 20 years.

- Annual capital cost = Total capital investment / Equipment operational life = €1,600,000 / 20 years = €80,000 per year.

Step 3: Operational and Maintenance Costs

- The annual operational and maintenance cost is €48,000.

- Operational and maintenance cost per unit of hydrogen = €48,000 / (1,589,414 cubic meters of hydrogen) = €0.0302 per cubic meter of hydrogen.

Step 4: Sum It Up

Now, sum up the calculated cost components:

- Electricity cost per unit of hydrogen: €0.133

- Annual capital cost per unit of hydrogen: €80,000 / 1,589,414 = €0.0503

- Operational and maintenance cost per unit of hydrogen at 90% capacity utilization: €0.0303

Step 5: Final Calculation

Total price of hydrogen per unit = €0.133 + €0.0503 + €0.0302 = €0.2135 per m3 of hydrogen.

Total LCOH in Kg = 2.4 Euros per Kg

In this case study, the estimated price of hydrogen using the alkaline electrolysis method is €0.346 per cubic meter. It is worth noting that this is a simplified example, and actual costs may vary based on specific circumstances and market conditions.

External Influences on Hydrogen Price

While the above calculation provides a foundation for understanding hydrogen pricing, it is essential to recognize that external factors can significantly affect the final price of hydrogen:

Hydrogen price can be influenced by supply and demand dynamics. A surplus of hydrogen production capacity relative to demand may lead to lower prices, while high demand and limited supply can drive prices upward.

The presence of multiple hydrogen producers in the market can lead to competitive pricing, as companies vie for market share. Competitive pressures can lead to cost-reduction initiatives and innovation in production methods.

Many governments worldwide are offering incentives and subsidies to promote hydrogen production and utilization as part of their environmental initiatives. These incentives can significantly reduce the overall cost of hydrogen production for companies.

Advancements in electrolyser technology and hydrogen production methods can enhance efficiency and reduce production costs. Staying abreast of these innovations is crucial for maintaining cost competitiveness.

Beneficiaries of Affordable Hydrogen

it is in the Energy-intensive sectors, where hydrogen can be used as a clean energy input, thereby reducing reliance on fossil fuels and curbing emissions.

The hard-to-abate sectors are responsible for a significant slice of all CO2 thrown into the atmosphere; Steelmaking by itself is the emitter of 7% of all CO2 emissions on bar with 7% of the cement industry; followed by Chemical and Petrochemicals with 4%, slightly ahead of Shipping and Railway respectively with 2.5% and 1% of carbon emissions. In addition, Industrial Heat generation contributes about 11% to CO2 emissions, which can also be alleviated by replacing gas with green hydrogen in many use cases. Altogether, these industries emit more than 32% of all human-produced CO2 and green hydrogen can mitigate that number significantly.

But the hard-to-abade sectors are not the only ones benefiting from Green Hydrogen. In the quest for decarbonization, industries such as automotive and aerospace stand poised to reap substantial benefits from affordable hydrogen. For automotive manufacturers, hydrogen fuel cells offer a promising alternative to traditional internal combustion engines, fostering zero-emission mobility solutions. Similarly, the aerospace industry envisions hydrogen as a clean propulsion choice, mitigating environmental impacts associated with air travel.

Strategies for Hydrogen Price Optimization

Realizing the transformative potential of hydrogen hinges upon concerted efforts to optimize its price competitiveness. As pioneers in hydrogen production technology, we advocate for a multifaceted approach to price optimization. Firstly, fostering research and development initiatives aimed at enhancing electrolyser efficiency and reducing capital costs.

Collaborative partnerships between public and private entities can expedite technological innovation and scale deployment. Furthermore, incentivizing renewable energy integration and streamlining regulatory frameworks can catalyze the transition towards cost-competitive green hydrogen production. Embracing circular economy principles and maximizing resource utilization also holds promise in driving down production costs.

Main Takeaways

In the paradigm shift towards sustainable energy ecosystems, the price of hydrogen emerges as a critical determinant of adoption and scalability. Concisely, the cost of green energy is the main driver of the hydrogen price and only by increasing the supply of renewable energy will we be able to reach lower hydrogen prices.

As technological innovators, we stay committed to advancing hydrogen production solutions that are both economically practical and environmentally sound. By solving the intricacies of hydrogen price dynamics and fostering collaborative strategies, we can build a future where affordable hydrogen is a cornerstone of decarbonization efforts.